Rollbacks unlikely on fuel standards

Auto industry welcomes President’s review of rules; public likes SUV gas guzzlers

3/19/2017

Automakers face strict emissions standards in other markets, including Europe and China. The standards in California are stricter than in the rest of the United States.

ASSOCIATED PRESS

President Trump’s pledge to review U.S. fuel economy standards is being painted by some as the first volley in an effort to take the auto industry back to an unregulated, high-pollution technological stone age.

Industry experts, though, are suggesting a much more nuanced view, saying while there may be some recalibrations, it’s exceedingly unlikely we’ll see a wholesale rollback of the standards.

U.S. regulators were supposed to review the fuel standards that were set in 2011 to see how automakers were progressing. Instead, Mr. Obama locked in the numbers.

For one, most automakers compete globally. That means they face strict emissions standards in other markets, notably Europe and increasingly in China, which is now the world’s largest market. There’s also California, whose statewide standards are stronger than the rules in the United States.

Carmakers also have made significant progress in making more-efficient vehicles. And even though fuel economy may not be at the top of the want list for buyers, it’s still an important consideration.

“These technologies have appreciably made new vehicles better,” said Ed Kim, an analyst with AutoPacific Inc. “I don’t think people are going to want to go backwards.”

There are challenges, though. Chief among them are the increasing costs for automakers and by extension, for consumers who buy new vehicles.

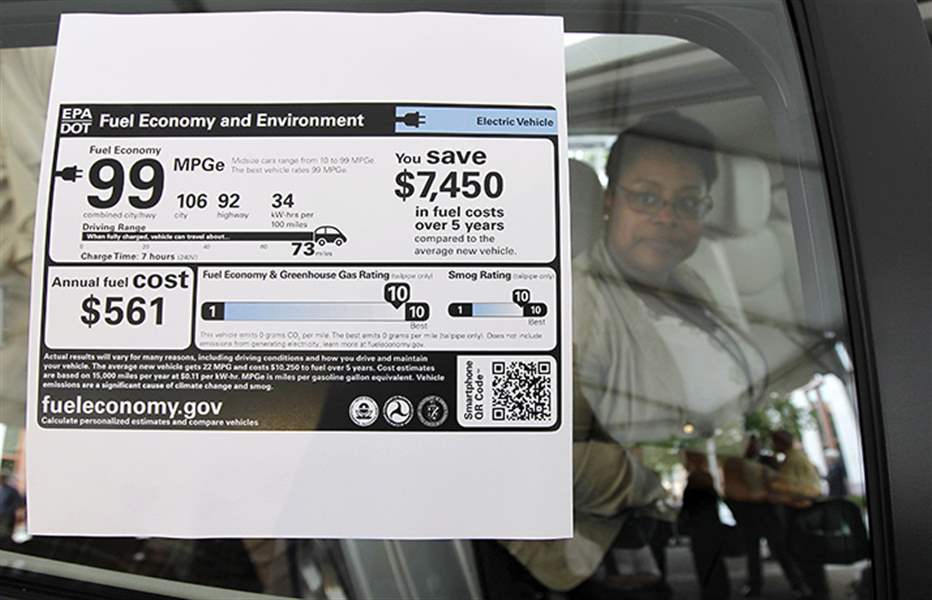

Estimates to how much cost the standards will add are all over the place. The U.S. Environmental Protection Agency most recently said costs would be $875 per vehicle — less than consumers would save at the pump over the life of their vehicle.

The industry believes costs will be much higher than the EPA estimate. Various studies and guesses have produced figures ranging from $1,200 to $4,000 per vehicle.

“That’s where the real rub is,” said Jay Baron, who leads the Center for Automotive Research in Ann Arbor. “The auto industry says it’s much higher than that. How much higher is in debate.”

Industry leaders fear higher vehicle prices could depress auto sales. Lower sales means lower production, which could mean fewer U.S. jobs. While the regulations primarily were focused on the environment and reducing the dependence on foreign oil, they were written to include economic analysis as well.

The Center for Automotive Research, in a 2016 report, estimated job losses tied to the 2025 fuel-economy standard could mean 137,900 fewer automotive manufacturing jobs and 1.1 million jobs total, though many have questioned the accuracy of those findings.

To understand the review President Trump has called for, it’s important to go back to the history of the fuel-economy standards.

In 2011, the Obama administration worked with leaders of 13 major automakers — including Ford Motor Co., General Motors Co., and Fiat Chrysler Automobiles — to come up with a regulatory framework that would require companies to hit certain efficiency and emissions standards, culminating with a corporate average fuel economy of 54.5 miles per gallon by 2025.

The government’s formula for calculating that is somewhat complex, but in simple terms it is weighted by sales volumes and vehicle size, and quantified in lab tests.

In the real world, the target fuel economy works out to an average of between 36 and 40 mpg. That doesn’t mean every new vehicle sold would have to hit those figures, but carmakers would have to average those figures across all vehicles they sell.

Automakers face strict emissions standards in other markets, including Europe and China. The standards in California are stricter than in the rest of the United States.

As part of the deal, government regulators and industry officials agreed to review the standards in 2017 and 2018 to see how automakers were progressing and examine whether changes are necessary.

The Obama administration pushed that review ahead, and just before leaving office, the outgoing president locked in the 2025 standards unchanged.

President Trump, in a speech delivered last week in Michigan, promised to reopen that review.

Politics aside, industry experts say essentially what the President has done is committed to the original plan.

“The midterm review was part of the deal. We’re going back to that. That’s all that’s happened so far,” said Michelle Krebs, an analyst with AutoTrader. “There are things that need to be discussed, that need to be debated.”

One issue of disagreement between the industry and the government is whether the 2025 goals can be met without widespread adoption of electric vehicles. The EPA, under President Barack Obama, said they could. The industry has suggested that’s unlikely. And given that the vast majority of buyers are still avoiding electric cars, that could be a problem. Even so, car companies aren’t saying the target is technologically impossible.

“None of the auto companies that I’ve heard have ever said they can’t meet the regulations,” Mr. Baron said. “The achievability of the regulations is not in question. It’s all about the economics.”

And that’s likely the thorniest of the issues President Trump’s review will deal with.

New vehicles already are hovering around record-high prices, and some say there’s a budding affordability issue now.

“Wages haven’t gone up, and people are stretching their loans out,” Ms. Krebs said. “The average is over 68 months now. People are doing that to keep their monthly payments down.”

According to research from Kelley Blue Book, the average U.S. transaction price for cars, sport utility vehicles, and pickup trucks was $34,352 in February. There’s a variety of reasons for that — more entertainment content and more safety systems are big ones — but getting better fuel economy plays a role. And with many of the easy gains already in place, getting to the 2025 target is going to be tougher, experts said.

So far, auto executives have been careful not to call for eliminating or even rolling back the standards. Instead, they’re saying they want to have the review that the Obama administration denied them.

“I think whatever the outcome is, I’ll feel better on the process,” Fiat Chrysler Chief Executive Sergio Marchionne told reporters last week.

Even if the target is rolled back or delayed, experts say automakers and suppliers aren’t likely to stop pursuing technology that allows for better fuel economy.

Mr. Kim, with AutoPacific, noted that carmakers have been doing quite well at meeting the fuel-economy targets so far. He also believes fears that the regulations would force buyers to purchase vehicles they don’t want have been significantly overblown. The shift to crossovers from cars, he said, isn’t changing what fuel economy drivers end up with.

“While people are getting out of Accords and into CR-Vs, they’re not sacrificing any fuel economy to get there,” he said.

“I would in fact argue that the existing standards have really pushed automakers to make these technological leaps that have been allowing customers to be able to drive the products they want, namely crossover SUVs, and still see big improvements in fuel economy as well.”

Contact Tyrel Linkhorn at tlinkhorn@theblade.com or 419-724-6134.