Downtown Toledo rental market grows in appeal

2/10/2018

The view from a new apartment in the Tower on the Maumee.

The Blade/Dave Zapotosky

Buy This Image

Over the past year, Ken Marciniak has taken five potential buyers to see a three-story office building at 415 Michigan St. in downtown Toledo.

Mere steps away from the Family Court Center and the Lucas County Courthouse, the building is situated perfectly for any business that complements the court system, Mr. Marciniak, a commercial real estate agent with Signature Associates, said.

Yet to his surprise, only one of the five parties wanted the building for office use. “The others were people wanting to convert it to apartments,” he said.

The view from a new apartment in the Tower on the Maumee.

In the late 1980s, only a handful of urban pioneers called downtown “home,” and their idea of entertainment was holding rooftop weenie roasts attended by two dozen at most.

But today, with companies like ProMedica moving to the Toledo core and a variety of after-dark entertainment generating crowds and excitement, the number of rental apartments and condos is now close to 2,800 units, said Mr. Marciniak, who compiled figures from a variety of governmental sources last year to do a residence headcount of sorts for his clients.

“What I notice — because I get downtown after 6 a.m. — is the pedestrian traffic in downtown Toledo is astonishing compared to what it was just two years ago,” he said. “There are all these people walking from their apartments to their jobs.”

ConnecToledo, formerly the Downtown Development Corp., has its own residential count.

It says there are 1,922 residential units within the boundaries of downtown — which it defines as the downtown core plus the Uptown, Museum, Vistula, Warehouse, Middlegrounds, and Main Street districts.

Another 232 apartments soon will be available, a ConnecToledo update shows.

Howard Olsen, construction manager for the Eyde Company shows off a new apartment in the Tower on the Maumee on Thursday.

“There's so much opportunity downtown, and we still have a lot to fill in,” Rachel Bach, ConnecToledo’s president and chief executive officer, said.

“A lot of what you’ve seen is ‘adaptive’ housing because of subsidies. Either state or federal historic tax credits were associated with the apartment projects because the costs are too high for new construction,” Ms. Bach said. “But you probably will, within the next two to three years, see some new construction.”

Two decades ago, getting Toledoans to choose downtown to live was a fairly difficult sell, experts said.

But over the years the addition of amenities like Fifth Third Field, the Huntington Center, and an accompanying entertainment district has changed attitudes about urban living, Mr. Marciniak and others said.

Ms. Bach, of ConnecToledo, said demand is now quite strong and continually growing.

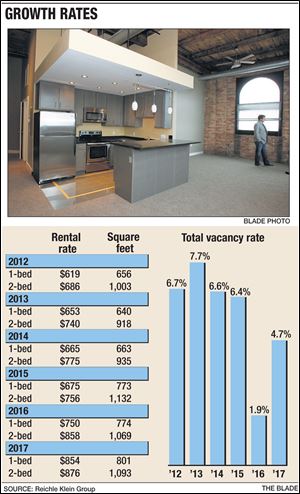

Five years ago the downtown apartment vacancy rate was 6.7 percent. At the end of last year it was 4.7 percent, according to the latest MarketView report by the Reichle Klein Group, a Toledo commercial real estate company.

The company’s 2017 year-end report also notes that the current strong demand will be addressed somewhat by 115 new rental units at the Berdan apartment building, which opened late last year; another 106 units at the new Tower on the Maumee high-rise, which will be ready for residents to move in this spring, and the previously announced 360-unit Gateway Lofts project at the Marina District in East Toledo that developer Frank Kass plans to open by fall 2019.

But the Downtown Master Plan, a study commissioned by the 22nd Century Committee, shows downtown can support another 1,200 to 1,500 housing units throughout the next 10 years.

There are two target groups for this housing. The first, as one might expect, is young professional singles and roommates who are most likely in the millennial generation, while the second group is couples and mid-career professionals.

The first group is almost exclusively renters seeking rehabbed housing and nightlife, while the latter seeks a mix of rental and for-sale housing in locations that put them close to lifestyle and cultural amenities.

The study foresees a need for 500 rental loft apartments, 500 standard apartments, 150 to 250 loft apartment or condos, 100 to 150 townhomes, and 100 to 150 low-rent “artist” lofts to attract those who want to play an active role in reviving the downtown.

Kevin Prater, half of the Lansing-based Karp and Associates team that owns and developed the 75-unit Standart Lofts apartments and the Berdan apartments, agrees that the demand is there for more housing, much of which will come online in 2019.

“There’s a number of a great opportunities” for new projects, said Mr. Prater, who will be involved in the development of the Nasby Building at Huron Street and Madison Avenue, and Fort Industry Square on Summit Street.

“If you’re a young person coming here, you want to be where there are people like you, that are like-minded,” Mr. Prater said. “Downtown Toledo’s got a lot of opportunity.”

Ms. Bach said there is a third demographic group that is emerging among the Toledo downtown residential movement — empty nesters.

“There are a number of empty nesters who are leaving the suburbs and want to own space downtown. They want to reinvest in the existing older buildings,” she said.

Ken Knight, 60, owner of the Knight Insurance Group on at 22 N. Erie St., is among those leaving the wider spaces of the metro area for a life in the city.

In May he bought the former Toledo florist exchange building at 14 N. Erie St., which is adjacent to his insurance offices, and is investing $3.5 million to turn it into first-floor company offices, a second-floor exercise facility for employees, and a 7,200-square foot third-floor loft apartment for him and his wife.

“We have a big house in Maumee and my wife and I are now empty nesters. We like to travel and it’s just hard to do when you have seven acres. The old house doesn’t seem to work for what we want to do,” Mr. Knight said.

“The idea of being able to walk to work is pretty exciting. We like having a rooftop deck overlooking and seeing the river. We’ll have a large parking lot and we’re even thinking of using some of the lot for green space so people driving past will have something pretty to look at when they first enter the city,” Mr. Knight said.

“We see a lot of young people coming down here and a lot of people who no longer want to be tied to the suburbs,” the insurance CEO said.

“We love downtown, and it’s so great to see these old buildings being used again,” he added.

Mark Clouse, CFO and general counsel for the Eyde Co. — which has owned the 28-story Tower on the Maumee since Owens Corning moved out of the former Fiberglas Tower high rise in 1998 — said it has been hard maintaining an empty building nearly 20 years with no real opportunity to redevelop it.

But the demand for housing downtown has become so strong that a few years ago the Eyde Co. ran the numbers and realized that a redevelopment had at last become economically feasible.

“It certainly took a lot longer than we had hoped,” Mr. Clouse said, adding the inquiries and wait now exceed the number of units they we have by four-fold.

“We see the market as strong,” Mr. Clouse said. “... People want to know exactly when they can move in.”

He said several units already have been reserved, while calls seeking information about available space are coming daily.

Until now, housing options downtown mostly have been limited to rehabs of buildings of lengthy historic significance. Tower on the Maumee, at just 50 years old, probably stretches the definition of “historic” by a wide margin.

But Lansing-based Eyde in 2012 was able to secure approval for the building and its adjacent garage to be put on the National Register of Historic Places. That designation helped the company qualify for state and federal historic preservation tax credits to rehab the tower.

“Take those [tax credits] away and a building like this probably won’t be rehabbed,” Mr. Clouse said.

Ms. Bach said adding more and varied housing options — like Tower on the Maumee — spurs more people to live downtown, which in turn helps push rents upward.

According to Reichle Klein’s MarketView report, a one-bedroom apartment in the central business district at the end of 2016 rented for an average of $750 a month. By the end of 2017, the rent had jumped 14 percent to an average of $854 a month.

Just five years ago, a one-bedroom apartment downtown rented for an average of just $619 a month, Reichle Klein data showed.

“We’re starting to see the rents catch up and also, as you offer more options, like condos, that also will help,” Ms. Bach said.

“As a result, you’re seeing a lot more developers coming around, folks within the region who have previously done more suburban-type projects. But this also is piquing the interest of more middle-market developers from outside the region,” she said. “We are a market that is certainly growing and we’re getting quality developers now who want to participate in that.”

However, Mr. Prater warned there’s a rent ceiling in Toledo that potential renters are reluctant to exceed. Some properties downtown are approaching it, though he declined to say what that price level is.

“Toledo’s a unique market. There’s a definite line on where the rents are capped at, and it is a line out there that no renter is willing to cross,” Mr. Prater said.

“Rent appreciation is not at the same rate as construction costs or labor rates. If your rent is too high, there are too many other low cost options for people, and they will go elsewhere. ... You can get a pretty nice house in the south end for $150,000,” he said.

“If the construction prices keep edging up, [rent caps] could become a concern,” Mr. Prater added.

For now, the economics of downtown housing still make new redevelopment projects feasible.

Mr. Clouse said the early success of Tower on the Maumee, which offer its renters some spectacular views, is tempting the Eyde Co. to consider doing additional downtown housing projects.

“We are looking at other properties because we think the market is just that strong. [Tower on the Maumee] won’t be repeated. But there are other opportunities with other properties that might have interest for us,” he said.

Ms. Bach said as housing opportunities expand, the next piece of the puzzle is to add more downtown retail.

“Certainly to attract more retail downtown we need more housing, heads and beds as they say,” she said.

Mr. Marciniak said additional retail might not be too far off.

“There’s been rumors for the last year about the Farmer’s Market securing more retail,” he said. “I think it’s time for a 30,000 to 40,000-square foot general merchandiser/grocer to go in there.”

Contact Jon Chavez at jchavez@theblade.com or 419-724-6128.