Webb unable to become Lucas County treasurer because of credit score

1/12/2018

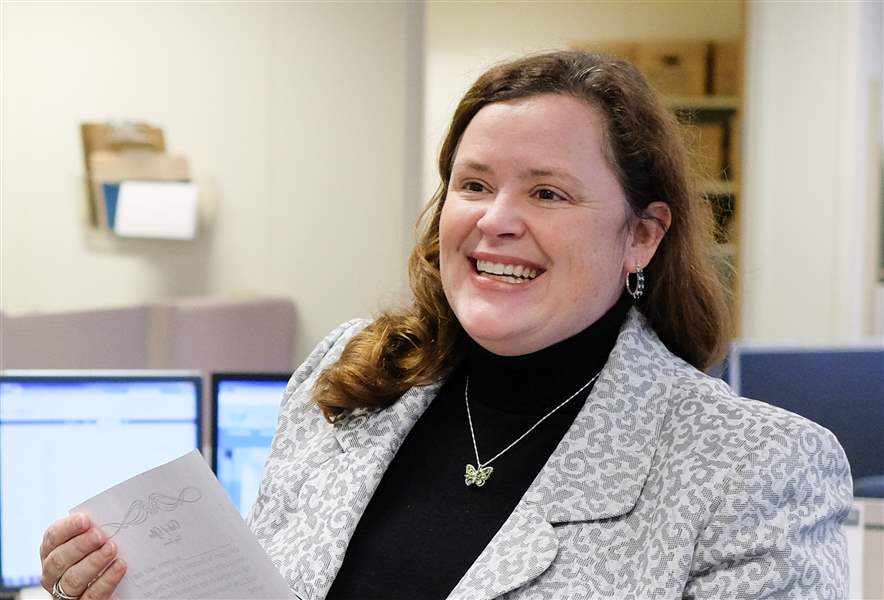

Lindsay Webb

THE BLADE

Buy This Image

Recently appointed Lucas County treasurer Lindsay Webb cannot fill her new post because of credit issues, forcing the county’s Democratic Party to once again pick a replacement for the office.

Ms. Webb said in a statement Friday she will not serve in the treasurer's role because she failed to secure a surety bond — a policy required for her to hold the job. Days after taking the oath, the former Toledo city councilman issued a statement outlining how an “error” further dragged down her “already stretched credit.”

EDITORIAL: How did Webb's credit woes surprise Lucas County Dems?

“I, like many people who struggle to make ends meet, knew I didn’t have stellar credit, but I never thought this would result in being denied a bonding necessary to be the treasurer of the county,” she said.

Ms. Webb said a county commissioner informed her shortly after the swearing-in that the county could not bond her. She then submitted a dispute with the credit reporting agency and a private student loan company. The latter improperly found her last payment 120 days late, when it was fully paid, Ms. Webb said.

Ms. Webb declined an interview request.

Lucas County Commissioner Pete Gerken said Ms. Webb’s appointment required three steps — approval by the Democratic Party Central Committee, because the outgoing treasurer was a Democrat; her taking the oath of office, and the securing of a $1 million surety bond.

“She’s done the first two, but she never assumed the office of treasurer technically because we have not been able to procure the surety bond,” Mr. Gerken said.

Mr. Gerken said county officials extensively sought offers for surety bond coverage, a process that typically takes an hour or so.

“We couldn't even get a quote,” he said. “We spent two solid days and nights trying to find a carrier on the primary and secondary markets.”

Mr. Gerken said treasurer bonds typically carries the highest premium. The law requires commissioners accept whatever offer was available to provide coverage, Mr. Gerken said. County records show Cincinnati Insurance Company most recently provided a $1 million bond for the Treasurer’s Office and total premium costs of $3,394 over four years.

In response to a public information request, Lucas County provided The Blade copies of emails containing insurance denials for Ms. Webb from Cincinnati Insurance Cos., USI Insurance Services, and Liberty Mutual. They were also turned down by CCI Surety, Bond Brokers, and the Surety Place, according to a summary document.

None of the documents cited a specific problem with Ms. Webb’s credit.

“Unfortunately due to the credit issues of the applicant, the underwriting conditions required to write the bond are onerous and not attractive,” wrote one insurance broker.

Lucas County Democratic Chairman Joshua Hughes said the screening committee had a six-page questionnaire that was supposed to root out whether a candidate had problems that would prevent them from holding office or getting elected.

“We have a thorough questionnaire which would flush out if someone had financial distress. She did not make us aware of any of this. I think that she could have been a little bit more transparent,” Mr. Hughes said.

He said the committee did not ask for a credit report from its applicants.

A questionnaire filled out by Ms. Webb said she had no bankruptcies, had never been fired from a job, had never made a claim under a surety bond, and had never been convicted of a crime worse than a traffic violation.

For now interim Treasurer Mark Austin remains in the job. The party central committee has a window of between five days and 45 days from the occurrence of the vacancy to appoint a treasurer.

It’s likely the party will recommend a replacement for Ms. Webb from among the two remaining applicants for the treasurer’s job, Oregon Councilman James Seaman, and state Rep. Michael Ashford (D., Toledo), Mr. Hughes said.

Ms. Webb, 42, of Shoreland, was appointed to replace fellow Democrat Wade Kapszukiewicz, who became mayor Jan. 2 after winning the 2017 general election. She resigned Wednesday from council and was then sworn in as county treasurer.

In her written statement she apologized to residents, as well as employees of both the treasurer’s office and the Lucas County Land Bank.

“Having already resigned from Toledo City Council, I feel it is best that I spend some time focusing on my family by returning to private life,” she said.

Mark Wagoner, a Republican state committeeman from Lucas County, said everyone wishes Ms. Webb and her family the best. He said it was clear the appointment “was made based on politics and not on qualifications.”

Ms. Webb was not the first county politician to run up against problems of poor personal credit.

In 2013, Lucas County Auditor Anita Lopez, while running for mayor, faced criticism over a credit score of 635 on the FICO scale, and with having $260,000 in personal debt. However, liability of the auditor is much lower than that of treasurer. State law requires a $1 million bond for the treasurer, but only a $20,000 surety bond for the auditor.

Former Mayor Carty Finkbeiner, who was in office during Ms. Webb’s first couple of years as councilman, issued a statement of sympathy. He said she was a dedicated councilman and was just as dedicated to her family.

“It’s been a challenge for her and I just feel the general public would appreciate knowing she has been as conscientious a family person as she was for them,” Mr. Finkbeiner said.

A review of county records show there are no liens or judgments filed on property Ms. Webb and her husband own.

Documents with the county recorder show that she and Robert Carter refinanced the loan in 2013 on the house they own in the Shoreland area near Point Place. They obtained a new loan for $174,669, records show. They purchased the house in 2009 for $189,000.

The couple also took out a mortgage for $66,500 in 2016 for a house they own in Point Place. Records show she bought the property in 2006 for $78,500 and paid off a note for the same amount two years later.

Staff writers Mark Reiter and Sarah Elms contributed to this report.

Contact Ryan Dunn at rdunn@theblade.com, 419-724-6095, or on Twitter @RDunnBlade.